The Poly-Pump Fake: Why Manufacturing Belief is More Profitable Than Predicting Reality

I. Prediction Markets Are Incentivized to Reward Influence Over Accuracy

Prediction markets were supposed to make the world smarter. The pitch was that by attaching real stakes to uncertain events, markets would reward those who sought truth, punish those who guessed, and when prediction markets scale up to the masses, they would produce an infrastructure of radical transparency. We suspect that this was the thinking that these markets would foster an efficient, collective search for truth is what motivated partnerships that both CNN and CNBC now have with Kalshi.

However, this rose-colored pitch fails to account for the core mechanic of profit for prediction markets: Prediction markets don’t reward truth; they reward those who can shape the momentum of truth. It doesn’t matter if what ends up being believed is the “truth” or not. Markets measure consensus; they do not measure the absolute truth.

We discussed in our previous work that as the U.S. economy begins to migrate from transactional purchases to purchasing probabilities (hypergamblification) and how there is a race for these companies to try to turn every conceptual category of life into a betting opportunity (what we called “monetized reality” but also encapsulated in Kalshi CEO Tarek Mansour to “financialize everything”). As this system overlays the economy, profound incentives appear. For traders, the profit motive dictates strategy: they will pursue any tactic that moves the odds. Profit is realized when the odds shift favorably, and since this price action can be driven by factors other than the event's true resolution before the market closes, accuracy is secondary to influence.

And this is where the critical insight emerges: in an economy increasingly built on gamblified incentive loops, the greatest profits will flow to those who can shape beliefs across different populations. This is the context for what we call in this paper the Poly-Pump Fake and this is a technique that depends on a crucial distinction between two fundamental concepts: accuracy and confidence.

II. Accuracy Versus Confidence: Why Markets Mistake Conviction for Truth

Prediction markets measure the intensity of belief, not the correctness of belief. They aggregate collective conviction efficiently, but this is not a guarantee that the resulting confidence is justified. This is why so-called "bonds" in prediction markets (a term used by the PM community for markets trading with probabilities between 80% and 95%) are not a guarantee of resolution, as many might assume.

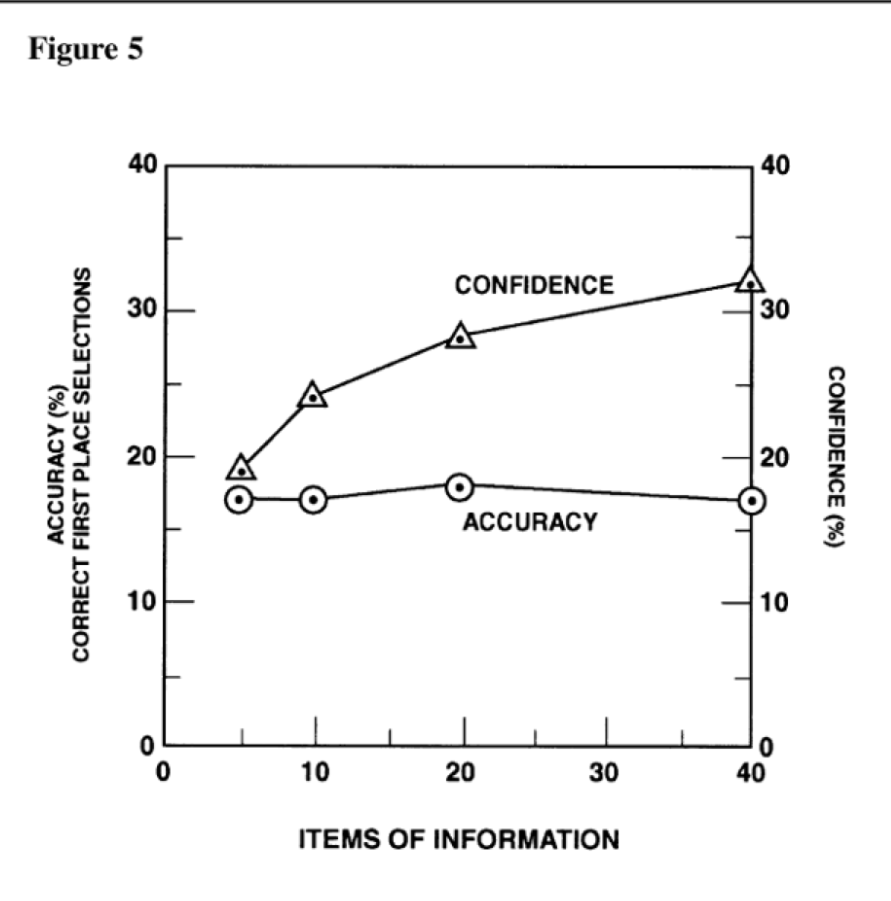

The structural weakness of relying on confidence is famously documented in intelligence analysis. Chapter 5 of The Psychology of Intelligence Analysis shows that as analysts receive more information, their confidence in their conclusions often rises sharply, while their actual accuracy barely moves. One example from the chapter describes horse-race experts where they grow more certain about their picks as they gather more data, but their win rate remains flat.

For the market manipulator, this Accuracy vs. Confidence distinction provides two primary avenues of attack:

Manipulating Accuracy (Kinetic or Direct Non-Kinetic Intervention): This involves taking an active hand in changing how an event will resolve. As we have explored in our papers on Assassination Semantics and The Importance of Understanding Non-Kinetic Intervention, this ranges from costly "kinetic interventions" (violence, direct action) to forms of "non-kinetic intervention" where a participant with access directly influences the outcome (e.g., bribing a referee, influencing a policy decision). Another recent example comes days ago of this paper’s publishing with the capture of Nicolás Maduro by U.S. forces (Operation Absolute Resolve) where Polymarket’s on-chain data shows at least three "insider" wallets that made over $630,000 on Polymarket by betting on his ouster when odds were at just 6%.

Manipulating Confidence (Indirect Non-Kinetic Intervention): This involves changing people’s beliefs about reality, which is almost exclusively achieved through non-kinetic means targeting the information ecosystem. This is about manufacturing the consensus that drives the trade. Consider Bill Ackman’s infamous 2020 TV appearance: while he spent nearly half an hour stoking public panic over the impending economic devastation of COVID-19, his fund sat on a massive $27 million bet that the markets would collapse. The resulting sell-off transformed that position into a staggering $2.6 billion profit, proving that in a panic, the person who defines the nightmare owns the market.

This second category where the manipulation of confidence induces a profitable trade will be the focus of this paper and is the operational core of the Poly-Pump Fake.

III. The Poly-Pump Fake: Convergence of Classic Market Manipulation Techniques

The Poly-Pump Fake is not a revolutionary concept; rather, it is a sophisticated convergence of four tried-and-true internet-age market manipulation strategies tailored for the hyper-liquidity of prediction markets. We have named it the Poly-Pump Fake (a term we use without prejudice toward any specific platform) because of the multi-dimensional complexity of the attack. The "Poly" acknowledges that a successful manipulation requires multiple information channels to be "pumped" simultaneously to create a false but profitable consensus.

The concept draws its structure from four distinct progenitors of online influence:

Political Disinformation for Profit (The Macedonian Model): In 2016, teenagers in Macedonia created sensationalist political narratives (such as the "Pope Endorses Trump" hoax) not out of ideological conviction, but purely to drive Facebook traffic and AdSense clickthrough revenue and profiting handsomely in the process. This is also the model that people who accuse certain parties of being a “grifter” are believed to be operating where the media personality doesn’t believe or care what they say as long as it is profitable with their audience. In both cases, the goal isn't to change the world, but to profit from the friction created by a polarized public.

Stock Market Head Fakes: This involves the use of fabricated content (hacked accounts, deepfakes, or fake press releases) to create artificial market signals. The goal is to generate rapid, short-term volatility based on false information, allowing the manipulator to enter or exit a profitable position before the deception is exposed. Here are four examples:

The 2013 AP Hack: A single hacked tweet from the Associated Press claiming an explosion at the White House had injured President Obama caused a 143-point drop in the Dow Jones in seconds.

The 2022 Eli Lilly Hoax: A parody "verified" account tweeting that "insulin is free now" erased $15 billion of the company's market cap in hours.

The 2023 Pentagon Deepfake: An AI-generated image of an explosion near the Pentagon briefly tanked the S&P 500, illustrating how synthetic media can trigger algorithmic sell-offs before the truth can catch up.

Sports Betting Head Fakes: Professional betting syndicates have long used "head fakes" where they plant rumors or what people believe to be inside information to move a betting line. By influencing the public’s perceived knowledge, they shift the odds to a favorable entry point before the truth is revealed. Conversations with sportsbook operators reveal a constant "cat-and-mouse" game against these sophisticated groups that trade on noise rather than news.

The Crypto "Rug Pull" and "Pump and Dump": The world of alternative cryptocurrencies likely provides the most relevant blueprint for the Poly-Pump Fake because many people coming into the prediction market space come directly from the cryptocurrency and NFT world. Using many means to get attention and belief towards their projects, crypto influencers hype a token (see the ill-fated Squid Game (SQUID) coin or the recent Hawk Tuah ($HAWK) coin) to drive up the price through manufactured “fear of missing out” (FOMO). Once the market hits peak confidence, the insiders dump their holdings (the "rug pull"), leaving retail investors with worthless assets.

The Poly-Pump Fake is the natural evolution of these strategies. It is a politically agnostic operation that seeks to create a false consensus by leveraging multiple sources to profit from the resulting volatility. We have already seen the first tremors of this kind of technique: the November 2025 "Institute for the Study of War Map Manipulation" incident, where an unauthorized edit to a frontline map briefly showed the capture of Myrnohrad, triggered a $1.3 million payout on Polymarket before the correction was issued. Even following the recent capture of Nicolás Maduro, we have seen people trying to capitalize on the attention of these geopolitical prediction markets by trying to come off as an insider putting down a lot of money (like on China capturing Taiwan before the end of 2026) and trying to get other bettors to copy-trade in order to try to pump up the market prices.

If this seems overwhelming right now, we want to point out that we are still at the VERY beginning of the potential of the Poly-Pump Fake with the main catalyst for the bigger explosion going to be the ever improving nature of generative AI.

IV. Generative AI: The “Splitting of the Atom” for the Poly-Pump Fake

While the Pentagon deepfake and recent crypto "rug pulls" utilize AI, they remain largely "hand-spun" operations. As AI capabilities evolve, the friction of human oversight is being removed. A single actor can now deploy a synthetic crowd to manufacture market confidence at scale through the following methods:

Persona Multiplexing: Using Multimodal LLMs to generate thousands of unique, context-aware social media accounts, "independent" blogs, and forged documents. These synthetic voices act in concert to echo a market-moving narrative, creating a false sense of consensus that is nearly impossible to distinguish from genuine grassroots belief.

High-Fidelity Forgery: The 2013 AP hack relied on a simple text tweet; the 2023 Pentagon deepfake was a crude image. Today, generative audio and video can simulate a "leaked" briefing or a "live" incident report with enough fidelity to trigger high-frequency algorithmic trading before human fact-checkers can even begin to investigate.

Weaponizing the “Fog of War”: AI doesn’t just spread blatant lies; it creates plausible noise in information vacuums. During active kinetic conflicts where bullets and bombs can make verified reporting difficult, the public and the 24-hour news cycle refuse to accept silence. In these moments of peak uncertainty, bettors crave any "insider" signal they can find to possibly profit off of. AI is uniquely suited to fill this vacuum with hyper-realistic, fabricated intelligence that feels authoritative, allowing a manipulator to plant a rumor that "sticks" simply because it is the only information available in the chaos.

V. Incentivized Insurgency: The Geopolitical Worst-Case Scenarios

The convergence of Generative AI and prediction markets creates a "Splitting of the Atom" moment for national security because it financializes the anticipation of tragedy. We are moving toward a reality where attackers do not just seek to destroy; they seek to harvest the volatility they create.

1. The "Trading on Terror" Precedent: History provides a grim blueprint for this. Following the October 7, 2023, attacks on Israel, researchers Robert J. Jackson Jr. and Joshua Mitts documented a massive, "extraordinary" surge in short-selling of Israeli ETFs and stocks just days prior. On October 2, short-selling volume in the MSCI Israel ETF (EIS) shot up to nearly 100% of off-exchange volume which exceeded the activity seen during the 2008 financial crisis or the COVID-19 pandemic.

In a Poly-Pump Fake scenario, an attacker could use AI to amplify this profit. By "pumping" a narrative of regional peace or stability across social media, they can artificially depress the price of "Attack Occurs" shares. They buy the "Yes" shares at a discount while the world is distracted by a synthetic calm or sustained uncertainty of what’s going on, then execute the kinetic strike. The market doesn't just predict the event, it funds the perpetrator.

2. The Reverse Pump: The "Cry Wolf" Exploit: Conversely, the Poly-Pump Fake can be used to manufacture "Pearl Harbor" moments that never happen. By using high-fidelity deepfakes and persona multiplexing to simulate a credible, imminent threat to US soil, an actor can spike the price of "Attack on US" markets. They exit their positions at peak panic, realizing massive gains from a crisis that was entirely hallucinatory. This creates a "Cry Wolf" effect that degrades the signal-to-noise ratio for actual intelligence agencies relying on OSINT, making the public and the markets numb to real warnings (see the phenomenon of “alarm fatigue”).

3. The Rise of Offshore "Attack Markets" on the U.S.: Recent cases of "insider betting" on military strikes have largely involved US or allied actions against foreign targets. However, we must prepare for a future where these markets focus on kinetic strikes against the United States. While US-regulated platforms like Kalshi enforce strict KYC (Know Your Customer) mandates under CFTC oversight, the global landscape is shifting toward total obfuscation. Even on platforms like Polymarket (where international users trade without KYC), the public nature of the blockchain allows for chain analysis that can eventually link a wallet to an identity. To circumvent this, the next generation of "Attack Markets" is migrating toward deeper layers of the stack:

Total Anonymity via Privacy Coins: Expect to see a shift toward decentralized platforms that utilize privacy-focused assets like Monero (XMR) and Zcash (ZEC). These tokens use ring signatures and zero-knowledge proofs (zk-SNARKs) to hide transaction amounts and participant identities, making traditional financial forensics impossible.

The Deep-Web Convergence: Betting platforms are increasingly running adjacent to dark-web marketplaces. By hosting these markets on Onion-routed servers (Tor) and utilizing decentralized oracles, adversaries can create a liquid, anonymous betting markets that essentially run like a bounty system for US national security failures.

Insider Intelligence as a Weapon: We have been fortunate that our adversaries have not yet fully weaponized "Betting Intelligence" (BETINT) on these insider bets around US-led military attacks. But when nation-states begin monitoring these signals to front-run US military responses, it puts the lives of our soldiers in immediate, quantifiable danger.

While a profitable "9/11" or "Pearl Harbor" market opportunity has not yet reached full scale, the infrastructure is already operational (as explored in our previous Semantic Assassination paper). As our economy and reality become further "gamblified," these US attack markets will become increasingly more local and specific.

VI. Establishing Frameworks for Assessing the Threat

To counter the Poly-Pump Fake and its associated non-kinetic interventions, national security agencies require a formalized architecture, ideally a BETINT (Betting Intelligence) Framework similar to the MITRE ATT&CK matrix for cyber threats. While this field of study is still nascent and we encourage grant agencies to fund more study around betting market mechanisms, BetBreakingNews is actively working on codifying the methodology used by adversarial actors to exploit the "Confidence-Accuracy Gap."

Specifically with the Poly-Pump Fake in mind, an ideal model for assessing the risk of an attempt would likely combine two core analytical structures: a Trust/Influence Chain and a Market Vulnerability Score.

Potential Framework Components:

The ATHENA Kill Chain (Trust and Influence): BetBreakingNews CEO Sean Guillory published this model that focuses on how adversarial actors establish influence over a target using AI. The phases (Access → Trust → Hook → Enrage/Entice → Normalize → Action) map directly onto the psychological steps required to get a betting community to accept a false narrative and act on it. When it comes to betting markets: the ATHENA Kill Chain maps the psychological and operational steps required to hijack a betting community’s conviction:

Access & Trust: The manipulator doesn't just "post"; they embed. Using Persona Multiplexing, they bypass "bullshit detectors" by building long-term credibility or compromising existing trusted nodes.

The Hook & Enticement: During a "Fog of War" event, the actor introduces a high-fidelity signal (e.g., a deepfake "leak"). This appeals to the trader's desire to be "first" and "right”.

Normalize & Action: Once the market moves, the price action itself becomes a "proof of truth," creating a feedback loop that entices the broader public to "buy the pump" while the manipulator prepares their exit.

Market Vulnerability Factors: Andrew Courtney's work on assessing the riskiness of a market identifies factors that expose a market to manipulation, including: Wide public interest (25%), Social usefulness of probability (20%), Breadth of information surface (10%), Resistance to manipulation (10%), Clear resolution criteria (10%), Hedge utility (10%), Market uniqueness (5%), Right level of difficulty / randomness (5%), and Useful path volatility (5%). An effective framework must leverage factors like these to identify high-value, high-risk targets.

Core Elements of Poly-Pump Fake Analysis:

Beyond the above mentioned frameworks, an effective operational model for conducting, assessing, or mitigating a Poly-Pump Fake must include the following critical components:

Goal and Audience Profiling: The attacker must understand more than just "making money." They must profile the target betting community like what are the sources they trust, what are the topics they find plausible, and which groups (demographics, political leaning) do they deem as easy to trick, often out of spite or prejudice?

Information Exchange Access: Success is dependent on finding access to the community's information exchange spaces (e.g. online forums, messenger groups, publications, or even real-life clubs). The attacker must gain access to where people trust receiving and sharing information, even if they harbor skepticism about certain parts of it.

Trust-Building and Staking: This is the phase that takes the longest. The attacker must conduct sufficient legwork to either become a trusted source within the community or gain the trust of the main influencers. Success is achieved when one knows exactly what messages will be believed, which channels and sources to push the information through, and when the market will react.

Exit Strategy: Any model must consider a clean egress from both the market and potentially the community. If the established alias staked its reputation on the false information, an immediate exit from the market and the digital community is a mandatory contingency.

VII. Conclusion: How BETINT Can Help

In a world where everything is a bet, everyone is a participant, and all information has price impact, the most profitable strategy is no longer predicting the truth; it’s shaping the consensus long enough to profit from the wave you created in the “fog”.

As we have seen, the "Truth Machine" pitch of these prediction market platforms fails the moment an adversary realizes they don't have to be right; they only have to move people. Truth pays eventually, but confidence pays immediately.

The infrastructure for an "Incentivized Insurgency" is already operational. From the Macedonian Model to potential Offshore Attack Markets running on Monero and Onion-routed servers, the threat to US national security is no longer theoretical. If we do not develop robust BETINT capabilities to track the coordinated movement of price, sentiment, and synthetic persona credibility, we leave our economic and kinetic security at the mercy of those who can pull off a successful Poly-Pump Fake.

BetBreakingNews is actively developing countermeasures and specialized workshop materials for government organizations, NGOs, and platforms. Understanding that we are living in a monetized reality is the first step; securing that reality is the next