A Future You Can Bet On: An Essay on the Growing Need for Betting Intelligence (BETINT)

When Everything’s a Bet, the Future’s a Gamble

We wonder what percentage of Americans would say they’ve never gambled. Any number larger than the percentage of Amish and electricity-free hermits left in this country would suggest a lack of awareness about what “gambling” actually is.

Tech Exchange: Betting Platforms Need to Take Their Data Seriously

This is the first article in our Tech Exchange series where we bridge the technologies and methodologies of two worlds: national security and the betting industry. In most of our work at BetBreakingNews, we show how betting intelligence (BETINT) feeds into security, forecasting, and strategy

Ghosts of Prediction Markets Past: How the U.S. Can Avoid the U.K.’s Collapse and Learn from Asia’s Success

The direction this industry takes will depend on two things: how operators treat sharp bettors and how regulators enforce their rules. If we get either of those wrong, the “bad ending” comes fast. But if we learn from history, the U.S. has a real chance to build the most innovative and trusted prediction market ecosystem in the world.

Assassination Semantics: Why Every Market Carries the Risk of Violence

When we published our earlier writing on non-kinetic interventions, we warned that markets do more than reflect belief. They offer incentives, create pressure, and sometimes encourage actions beyond just placing bets. We said we would follow that up with a paper on kinetic interventions where death, incapacitation, or physical harm become not just possibilities, but embedded options in market logic. What happens when a market that seems innocent or generic becomes an implicit assassination market? Recent events make the question urgent.

The Importance of Understanding Non-Kinetic Intervention in Event Markets

When we published our earlier writing on non-kinetic interventions, we warned that markets do more than reflect belief. They offer incentives, create pressure, and sometimes encourage actions beyond just placing bets. We said we would follow that up with a paper on kinetic interventions where death, incapacitation, or physical harm become not just possibilities, but embedded options in market logic. What happens when a market that seems innocent or generic becomes an implicit assassination market? Recent events make the question urgent.

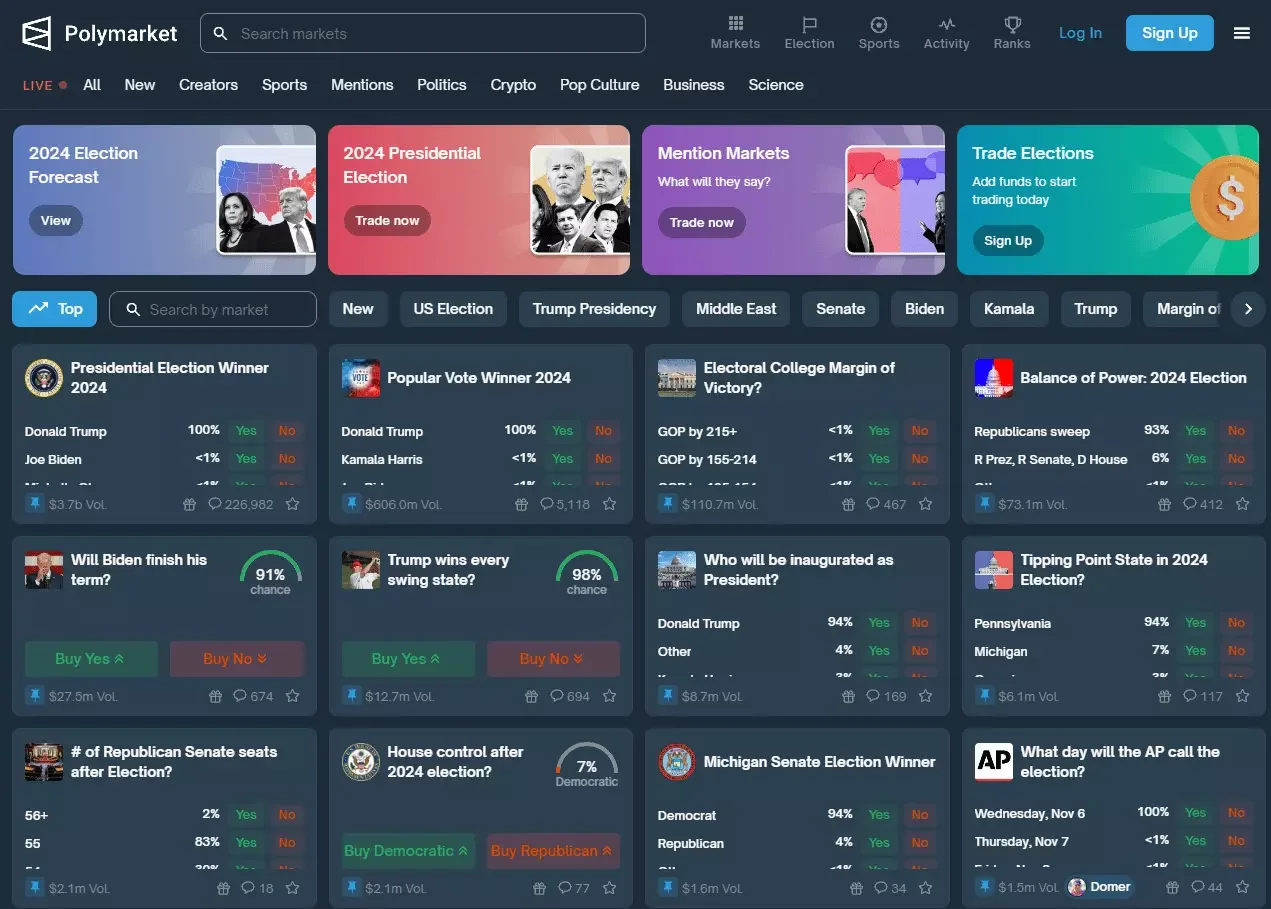

Why Polymarket US Won't Be The Polymarket We Know and Love

When Polymarket announced that it had secured CFTC approval to launch in the United States, the immediate question wasn’t just when it would launch (though there is a Polymarket market on that) it was what Polymarket would show up on American soil. The company has been teasing its U.S. rollout on its site, but the fine print is already clear: Polymarket US won’t look like the wild, crypto-driven, offshore marketplace that captured headlines during the 2024 election cycle. In fact, it will be an entirely separate platform.

And that raises our central question: Will Polymarket US actually still be Polymarket?

What We’re Trying to Do Here

Prediction markets and betting on world-events are currently entering a new era. The legal decisions that ushered in this new era all come courtesy of the Kalshi market: (1) 2020 they became the first fully CFTC-approved prediction market exchange in the U.S.; (2) 2024 a court appeals decision allows them to list political events on their markets; and (3) right before the 2025 SuperBowl, Kalshi started adding sports-related event contracts which at the time of this writing, allows sports related betting to all 50 states without needing the approval of individual state gaming commissions that other sports betting books are required to go through since